Our Estate Planning Attorney PDFs

It is additionally possible that it will be altered as an outcome of the adjustment of administration in 2020. The Illinois inheritance tax limit amount is $4,000,000 and an estate with even $1 over that amount undergoes tax obligation on the whole amount. A person whose estate goes beyond these exception or limit levels needs to do some additional estate planning to minimize or get rid of fatality taxes.

However, the Illinois inheritance tax limit is not mobile. Typically, a gift of property from an individual to his or her partner who is an U.S. citizen is not subject to a present tax obligation or an estate tax obligation. Presents to any person else is a taxed present, however goes through a yearly exclusion (gone over below) and the exact same lifetime exemption as for federal inheritance tax.

The 20-Second Trick For Estate Planning Attorney

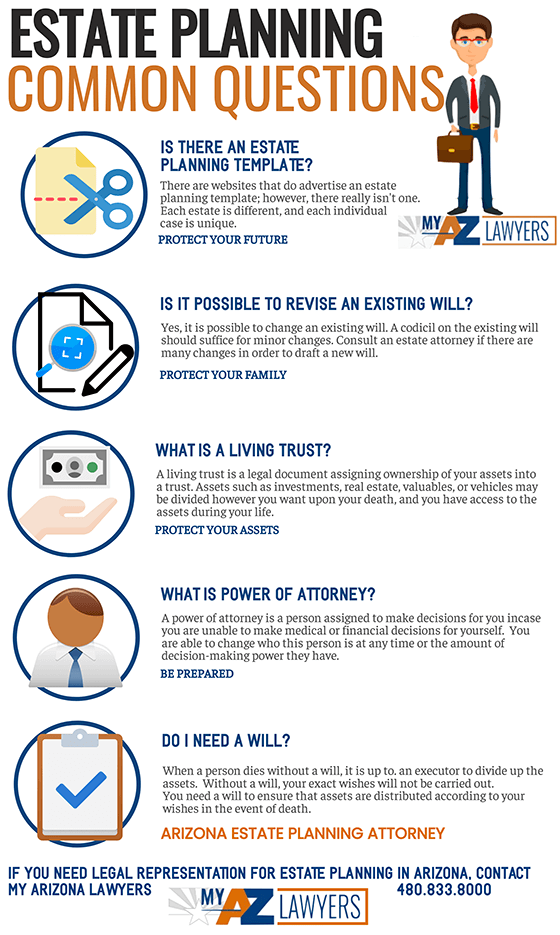

Some estate plans might consist of life time gifts. In 2020, an individual might quit to $15,000 a year to anyone without a gift tax. On top of that, under particular scenarios, a person can make gifts for clinical costs and tuition costs above the $15,000 a year restriction if the medical settlements and tuition repayments were made directly to the medical company or the education provider.

Each joint renter, no matter of which one acquired or originally had the property, has the right to use the jointly had building. When two people own building in joint tenancy and one of them dies, the survivor becomes the 100 percent owner of that residential property and the dead joint lessee's interest ends (Estate Planning Attorney).

There see this here is no right of survivorship with tenants-incommon. When a tenant-in-common passes away, his/her interest passes to his or her estate and not to the surviving co-tenant. The residential or commercial property passes, instead, as part of the estate to the heirs, or the beneficiaries under a will. Occupancy by the whole enables spouses to hold their primary residence devoid of claims versus just one partner.

Indicators on Estate Planning Attorney You Need To Know

At the fatality of the owner, the possessions in the account are transferred to the marked beneficiary. Illinois has actually recently taken on a law that allows particular real estate to be moved on death via a transfer on death tool.

The beneficiary of the transfer on fatality instrument has no passion in the genuine estate till the death of the proprietor. All joint tenants have to accept the sale or home mortgage of the residential property. Any one joint occupant may withdraw all or a component of the funds in a joint bank account.

Estate, present, or revenue taxes might be affected. Joint occupancy might have other repercussions. For instance: (1) if residential property of any kind of kind is held in joint tenancy with a loved one who receives well-being or various other benefits (such as social protection benefits) the relative's entitlement to these advantages might be jeopardized; (2) if you put your house in redirected here joint occupancy, you might lose your right to beneficial elderly person genuine estate tax obligation therapy; and (3) if you create a joint tenancy with a kid (or any individual else) the youngster's creditors may look for to accumulate your youngster's debt from the residential property or from the profits of a judicial sale.

Nevertheless, joint tenancies are Related Site not a basic service to estate issues but can, in fact, develop troubles where none existed. The expenses of preparing a will, tax preparation, and probate may be of little importance compared with the unintended troubles that can develop from utilizing joint tenancies indiscriminately. For a complete explanation of the advantages and negative aspects of joint tenancy in your specific situation, you need to get in touch with an attorney

Comments on “Estate Planning Attorney Can Be Fun For Everyone”